Learn About the Energy-Star Tax Credits Available for Pioneer SystemsUpdated 2 days ago

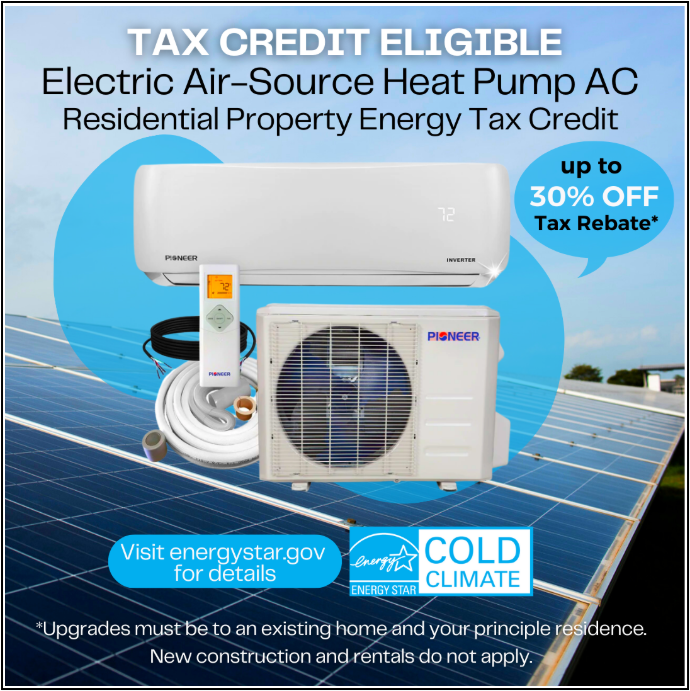

From 2023 until 2032, the government has established a Federal initiative to reward the purchase of eco-friendly, high-efficiency HVAC equipment in the form of a tax credit. There may also be other local incentives, grants, and rebates in your area that are given by electric companies or municipalities.

The quickest way to see what rebates are available for which systems in your zip code is to use our Rebates Center.

If you purchase an Energy-Star certified system that meets certain efficiency requirements, you could get back up to $2,000 in tax credits when filing your yearly tax return.

What Makes a Unit "Energy-Star" certified?

The HVAC system must meet certain efficiency requirements in order to be certified as Energy-Star. If you would like full details about the latest specification for Energy-Star systems, we encourage you to peruse the latest 6.1 version of the specification located below:

Note: There are two types of Energy-Star equipment:

- Energy-Star

- Energy-Star Cold-Climate (more relevant to North regions which use more heating)

Pioneer systems are almost always split-type and air-source, and will always be heat pumps. Refer to Table 2 and Table 3 on Page 4-5 of the above document.

How Does the Tax Credit Program work?

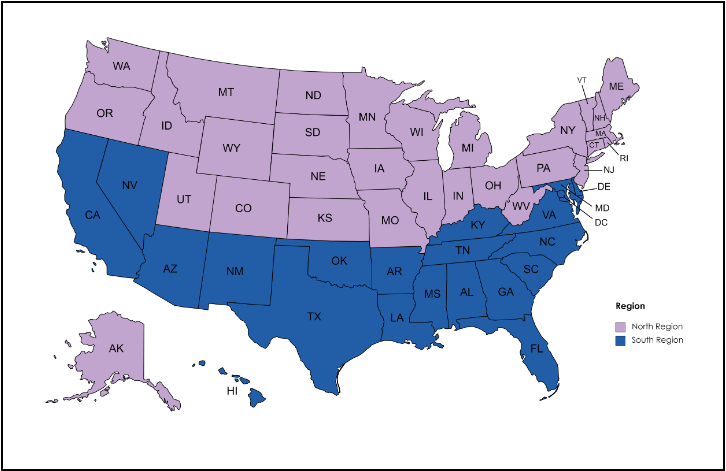

The program has two different requirements based on the region where the system is to be installed (North and South). Start by checking which region you reside in, then check the relevant requirements for that region.

Details are subject to change and the most up-to-date requirements should be checked directly on the Energy-Star website.

NORTH

"North" Region Definition

The North specifications include the National DOE region and also include all Canadian provinces as they are heating dominated. The North and Canada Region includes the following states: Alaska, Colorado, Connecticut, Idaho, Illinois, Indiana, Iowa, Kansas, Maine, Massachusetts, Michigan, Minnesota, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New York, North Dakota, Ohio, Oregon, Pennsylvania, Rhode Island, South Dakota, Utah, Vermont, Washington, West Virginia, Wisconsin, and Wyoming.

Efficiency Requirements

Ducted

- Heat pumps designated as Energy-Star Cold Climate that have an EER2 ≥ 10

Ductless (mini-splits)

- Energy-Star Cold Climate heat pumps with

- SEER2 ≥ 16

- EER2 ≥ 9

- HSPF2 ≥ 9.5

SOUTH

"South" Region Definition

The South specifications include both the Southeast and Southwest DOE regions. The South Region includes the following states: Alabama, Arizona, Arkansas, California, Delaware, the District of Columbia, Florida, Georgia, Hawaii, Kentucky, Louisiana, Maryland, Mississippi, Nevada, New Mexico, North Carolina, Oklahoma, South Carolina, Tennessee, Texas, and Virginia.

Efficiency Requirements

Ducted

- All heat pumps that have earned the Energy-Star label

Ductless (mini-splits)

- Energy-Star certified heat pumps with

- SEER2 ≥ 16

- EER2 ≥ 12

- HSPF2 ≥ 9

To see the full details about the initiative, check out the program description provided by the Consortium for Energy Efficiency below:

How Do I Claim the Credit?

The credit is claimed once you submit your tax return in the following year. For example, if you buy the unit in 2023, you would claim the credit when you submit your tax return in 2024.